Valuation Services In Vadodara

Best Valuation Services in Vadodara

Navigating the Art and Science of Valuation

“The true value of a business is not defined by what has been invested in it, but by the wealth it can generate.”

India has a long-standing history of valuation practices, dating back to ancient times when valuations were conducted primarily for taxation and land assessment. Over the years, business valuation in India has evolved significantly, adapting to dynamic economic landscapes, regulatory frameworks, and global financial standards.

Valuation Services in Vadodara

As markets evolved, business valuation became essential for mergers, acquisitions, and financial planning. In the 21st century, stricter regulations have refined valuation practices, making them a crucial part of India’s growing business ecosystem.

Today, valuation is more than just numbers it helps businesses assess opportunities, manage risks, and make informed financial decisions. Explore the insights, understand the financial landscape, and unlock the true potential of business valuation in India.

Get Professional Help

Business Valuation: The Principle (Expert Valuation Services in Vadodara)

Business valuation is a critical financial process that determines a company’s true economic worth by assessing its assets, liabilities, market position, and overall financial health. These services are essential for mergers and acquisitions, business sales, investment planning, financial reporting, tax optimization, and litigation support.

By utilizing advanced valuation methodologies and data-driven analysis, professional valuation services provide precise, compliant, and strategic insights. This enables business owners, investors, and stakeholders to make informed decisions, maximize value, and drive long-term financial success.

Closed Multiple valuations across various sectors.

Dedicated team of sector specialists and specialization for instruments

Completed 100+ Fund Raising deals.

650+ successful transactions.

Over 10 years of combined experience,

Empanelled with various PSU Banks and Financial Institute.

Unlock Your Business Value Today – Choose N Pahilwani & Associates for Expert Valuation

Valuation Services in Vadodara – Our Valuation Offerings

The primary objective of business valuation is to accurately assess a company’s financial worth by analyzing key factors that influence its market value. This process involves evaluating tangible and intangible assets, financial performance, industry trends, market position, and future growth potential.

By integrating these elements, business valuation provides a data-driven and precise estimate of a company’s value, helping business owners, investors, and stakeholders make strategic and well-informed decisions for growth, investments, and financial planning.

There are several business valuation methodologies, each offering a unique perspective on a company’s worth. These approaches include:

This method involves a comparative analysis, where the business is assessed by comparing it to similar enterprises that have recently been transacted in the market.

This approach focuses on evaluating the present value of anticipated future cash flows generated by the business. It provides insights into the company’s value based on its income-generating potential.

In this approach, the value of the business is determined by considering both tangible and intangible assets while deducting liabilities. This method offers a comprehensive understanding of the company’s net asset value.

This method involves estimating the cost required to replicate the business with comparable assets and liabilities. It provides an insight into the value of the company by assessing the expenses associated with recreating its structure.

Business valuation services are essential for business owners, investors, and stakeholders, providing accurate insights to support mergers, acquisitions, sales, and strategic planning.

By determining fair market value, these services help ensure smooth negotiations, fair deals, and informed decision-making in business transactions. Additionally, accurate valuations enhance financial reporting compliance, improving transparency, credibility, and regulatory adherence for private companies.

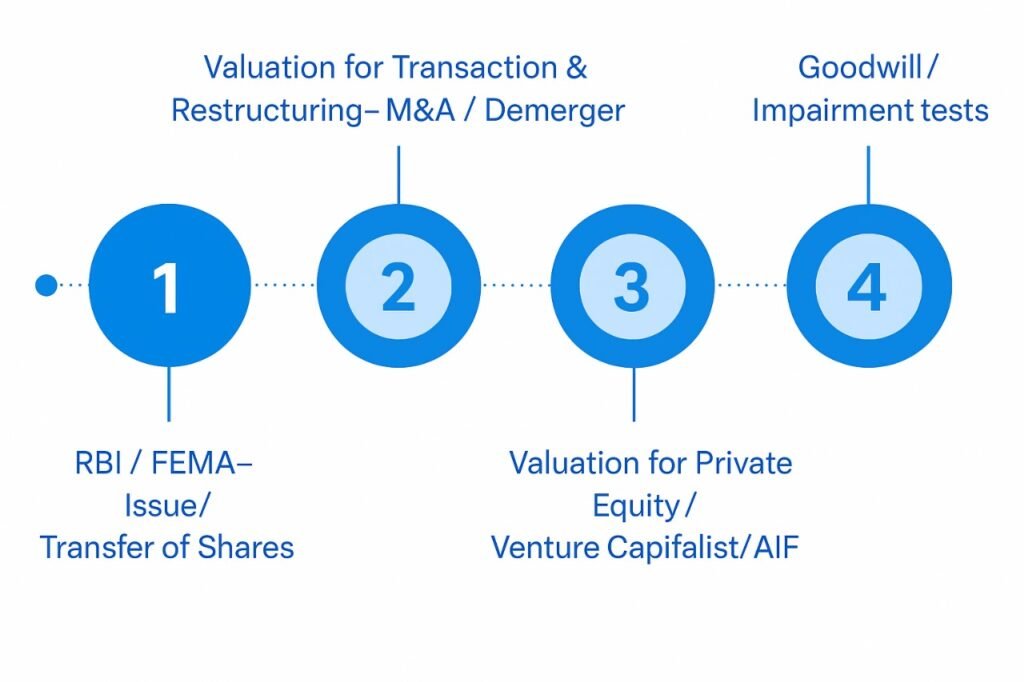

BUSINESS VALUATION

- Companies Act

- RBI / FEMA- Issue/ Transfer of Shares

- Income Tax — ESOP, Issue / Transfer of Shares

- SEBI- Delisting, Takeover Code, ESOP

- IBBI- Insolvency / Liquidation Valuations

- Valuation for Transaction & Restructuring- M&A / Demerger

- Acquisition related valuations

FINANCIAL REPORTING VALUATION (IND AS, IFRS & US GAAP)

- Purchase Price Allocation

- Goodwill / Impairment tests

- Intangible Asset Valuation [Patents, Brand, Trademarks]

- Financial Instruments [Derivatives, Hybird, Convertibles]

- Valuation for Private Equity/Venture Capitalist/AlF Fixed Assets valuation

SPECIALISED VALUATION

- Fairness Opinion

- Real Options

- Arbitration, Litigation and

- Dispute Valuation

- Family Settlement

- Claim for Damages Valuation

VALUATION ADVISORY

- Financial Modelling

- Capital Budgeting Decision

- Value Enhancement

- Negotiation Support

Ready to Make Informed Decisions? Trust N Pahilwani & Associates for Accurate Business Valuations.

Additionally, these services support strategic tax planning, equity issuance, litigation credibility, ESOP implementation, strategic insight, risk assessment, and succession planning, aiding in effective long-term business strategies. Overall, business valuations play a pivotal role in optimizing financial decisions and organizational growth.

Discipline Of Valuation

Let’s briefly discuss the scope of valuation under different regulations.

Under the Companies Act, 2013, registered valuers designated by the IBBI are mandated to conduct valuations for unlisted companies in various transactions, such as allotment of securities, issuance of sweat equity shares, private placement of shares, and valuation of undertakings or assets.

In the Insolvency and Bankruptcy Code (IBC), valuation is crucial at different stages, as per IBBI regulations. This involves appointing registered valuers to determine fair value and liquidation value in processes like CIRP, Voluntary Liquidation, and Fast Track Insolvency Resolution, ensuring independence and restricting specific affiliations for valuers.

In case on FEMA, Valuation is required whenever there is issue or transfer of shares happen between resident and non-resident. For listed company in India, valuation will be as per Market price SEBI Preferential allotment. For Unlisted company, Valuation Report is required from Chartered Accountants as per International accepted Valuation Standard as prescribed by International Valuation Standards Council

Valuation under IFRS is crucial for determining carrying amounts, recognizing gains, measuring goodwill, and assessing impairment, aligning with IFRS’s goal of providing reliable financial information.

IFRS mandates valuation for transparent financial reporting. IFRS 13 guides fair value measurement, IFRS 9 emphasizes initial recognition of financial instruments at fair value, and impairment considerations are in standards like IFRS 36, IFRS 28, and IFRS 41.

N Pahilwani & Associates – Valuation Experts in Vadodara

N Pahilwani & Associates is a leading financial and advisory firm in Vadodara, Gujarat, offering expert services in Accounting Advisory, Startup Advisory, Income Tax, GST, Finance & Capital Advisory, and Regulatory Compliance.

Our team of Chartered Accountants, Company Secretaries, Lawyers, and Chartered Financial Analysts specializes in business valuation, financial reporting valuation, and customized valuation solutions, ensuring accurate and strategic financial insights.

With a strong focus on precision and expertise, we help businesses navigate mergers, acquisitions, financial planning, and compliance with confidence. For reliable and data-driven business valuation services in Vadodara, trust Nexpective Advisors to deliver excellence.

Elevate Your Business with N Pahilwani & Associates – Your Partner in Strategic Valuation Excellence.

News & Update

Frequently Asked Questions

In business, valuation is the process of determining the economic worth of a company or asset. It involves assessing factors like financial performance and market conditions to make informed decisions about buying, selling, investing, or strategic planning. Different methods, such as income and market approaches, are used for this assessment.

Business valuations come in various forms, including Asset Valuation (assessing the value of tangible and intangible assets), Market Valuation (determining value based on market comparisons), and Income Valuation (evaluating future income potential). Each method provides unique insights, helping businesses make informed decisions about their worth and strategies.

Stay updated on the latest trends shaping business valuation, including the impact of technology, evolving market dynamics, and regulatory changes, to make informed decisions in today’s dynamic business environment.

Businesses benefit from specialized valuation services by gaining accurate insights into their worth, identifying growth opportunities, and making informed financial decisions, guiding strategic choices for sustainable growth and success.

Company valuations in India are typically performed by qualified professionals such as Chartered Accountants, Registered Valuers, and specialized valuation firms. The Institute of Chartered Accountants of India (ICAI) and the Insolvency and Bankruptcy Board of India (IBBI) regulate and accredit valuers in the country.

A business valuation’s validity is typically three months to six months, contingent on factors like the purpose and market conditions. Reassessment is recommended with significant changes in the business or market dynamics.

Equity value is the total value of all outstanding stock of the company whereas enterprise value is the total net worth of a company net of cash and debt.

Equity value is calculated by multiplying price of a single share of stock with the number of shares outstanding whereas enterprise value is calculated after deducting cash, investments and debt from equity value.